Investing in real economythrough trade finance

We create impact through financing real economy by facilitating international trade transactions and making it consistently profitable for our investors

Regulated by CySEC (Licence Number: AIF74/2018)

Global leading international trade orientation from a Eurozone regulated entity

Sound positioning in Cyprus becoming a reference for European markets. The Fund Management, Administrator and Audit functions are covered by some of the largest regulated companies of CySEC, who work alongside Eurobank Cyprus - serving as Depositary - providing a strong AML, compliance and legal muscle to protect the interests of the investors and the clients.

How we serve our Investors

Welcoming Professional & Well-Informed Investors

Our investors can include family offices, successful entrepreneurs, established professionals, business owners and those banking through family offices. REF can also work alongside other Funds or serve institutional plans by providing an enriched portfolio of assessed trades and servicing the management of the capital to facilitate the goals set by each of these organizations and institutions.

Investment Philosophy

The Fund’s investment philosophy concentrates on the thorough due diligence and the active management of all participations, given the solid trade finance transactions structuring and risk management track-record of the REF team in order to safeguard investors’ interests and maximize returns.

Investor's Subscription

Minimum subscription: EUR 125.000

Investors will be able to redeem their shares after one year from the date that they have subscribed in the Fund, on each quarterly valuation date with a minimum of three months’ notice.

Investment Enquiries

Our team are ready to help answer any questions you may have

CY +357 2239 7714

UK +44 (0) 7531587194

GR +30 6972776403

a.symeonidou@realeconomyfund.com

Investment Strategy

Direct new capital into the acquisition of trade receivables across trade value chains linked to developed markets. Acquire receivables with quick turnover, yielding strong commission revenues. Invoice Discounting can yield strong risk-adjusted returns in this environment.

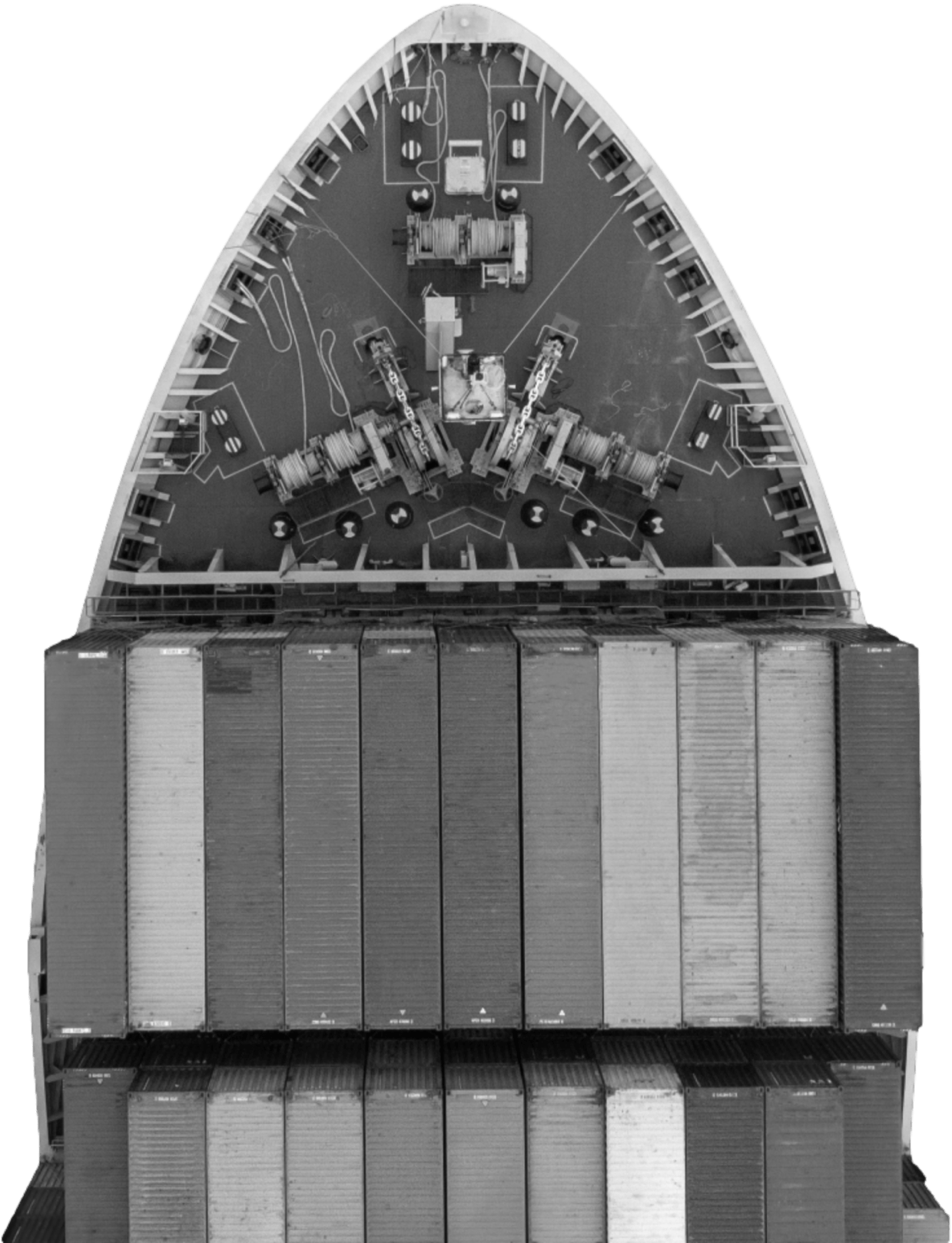

Facilitating trading, beyond barriers

Serving as an independent player with the flexibility of joining forces with the right strong partners allying with other Factoring Companies and Funds.

Complement the “over and above” requirements of clients to their existing factoring lines, to accommodate seasonality of transactions.

Origination Capabilities

The company’s business activities capitalise on the extensive domestic and international network of contacts, knowledge and expertise that founders and the investment committee have developed during their long and successful engagement with the factoring and forfaiting industry during the last 30 years.

FCI two-factor collaborations

Engagement with the FCI through the associate membership enhances the strong reputation in the region and expands a wide network of contacts in domestic and international markets. The team maintains engagement in factoring activities with a number of strategic clients and has the ability to quickly scale up factoring services on the existing clientele.

Investment Portfolio

REF being a Trade Finance fund invests only in the financing of the short-term activities of targeted companies without any participation in the companies’ equity capital. The Fund participates in the full trade cycle of B2B transactions by providing working capital for import financing, pre-export financing, trade payables & receivables financing/ discounting of invoices and other commercial instruments.

Guaranteed liquidity Self-secured (by the underlying goods and trade receivables) The investor is not exposed to any volatility or market fluctuation or the risks inherent to investing in securities or bonds, simply because it finances activities in international trade. Investing in trade receivables has proved to be notably resilient to financial market shocks The trade receivables market has proved more resilient and was less affected even during the covid-19 pandemic, compared to other asset classes

Alternative Investments Fund

An alternative investment fund (AIF) is type of collective investment where funds are raised from a number of investors with a view to investing them in accordance with a defined investment policy. As a Variable Capital Investment Company (VCIC), we invest in our Portfolio the funds based on the number of investors and their invested capital.

What’s New

Latest News around the globe

By following the news, you can reach up-to-date information and news about us here.

Contact Real Economy Fund

Our team are ready to help answer any questions you may have: a.symeonidou@realeconomyfund.com